扫码下载APP

及时接收考试资讯及

备考信息

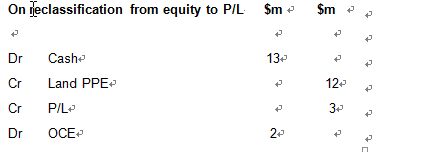

If IAS 16 PPE allowed the reclassification from equity to P&L as a reclassification adjustment, the profit on disposal recognised in P&L would be $3m including the $2m reclassified from equity to P&L and the last two double entries above replaced with the following.

IFRS 9 also prohibits the recycling of the gains and losse on FVTOCI investments to P/L on disposal. The no reclassification rule in both IAS 16 PPE and IFRS 9 means that such gains on those assets are only ever reported once in the statement of profit or loss and other comprehensive income – ie are only included once in total comprehensive income. However many users, it appears, rather ignore the total comprehensive income and the OCI and just base their evaluation of a company’s performance on the P/L. These users then find it strange that gains that have become realised from transactions in the accounting period are not fully reported in the P/L of the accounting period. As such we can see the argument in favour of reclassification. With no reclassification the earnings per share will never fully include the gains on the sale of PPE and FVTOCI investments.

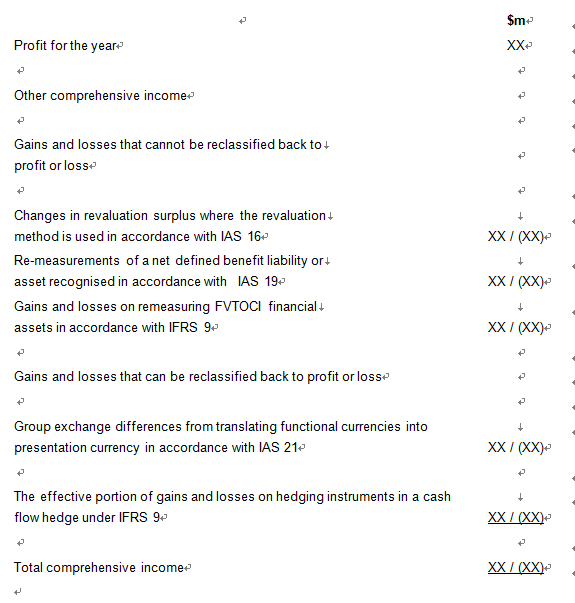

The following extract from the statement of comprehensive income summarises the current accounting treatment for which gains and losses are required to be included in OCI and, as required, discloses which gains and losses can and cannot be reclassified back to profit and loss.

Extract from the statement of profit or loss and other comprehensive income

The future of reclassification

In the July 2013 discussion paper on the Conceptual Framework for Financial Reporting the role of the OCI and the reclassification from equity to P/L is debated.

No OCI and no reclassification

It can be argued that reclassification should simply be prohibited. This would free the statement of profit or loss and other comprehensive income from the need to formally to classify gains and losses between P/L and OCI. This would reduce complexity and gains and losses could only ever be recognised once. There would still remain the issue of how to define the earnings in earnings per share, a ratio loved by investors, as clearly total comprehensive income would contain too many gains and losses that were non-operational, unrealised, outside the control of management and not relating to the accounting period.

Narrow approach to the OCI

Another suggestion is that the OCI should be restricted, should adopt a narrow approach. On this basis only bridging and mismatch gains and losses should be included in OCI and be reclassified from equity to P/L.

A revaluation surplus on a financial asset classified as FVTOCI is a good example of a bridging gain. The asset is accounted for at fair value on the statement of financial position but effectively at cost in P/L. As such, by recognising the revaluation surplus in OCI, the OCI is acting as a bridge between the statement of financial position and the P/L. On disposal reclassification ensures that the amount recognised in P/L will be consistent with the amounts that would be recognised in P/L if the financial asset had been measured at amortised cost.

The effective gain or loss on a cash flow hedge of a future transaction is an example of a mismatch gain or loss as it relates to a transaction in a future accounting period so needs to be carried forward so that it can be matched in the P/L of a future accounting period. Only by recognising the effective gain or loss in OCI and allowing it to be reclassified from equity to P/L can users to see the results of the hedging relationship.

Broad approach to the OCI

A third proposition is for the OCI to adopt a broad approach, by also including transitory gains and losses. The IASB would decide in each IFRS whether a transitory remeasurement should be subsequently recycled.

Examples of transitory gains and losses are those that arise on the remeasurement of defined benefit pension funds and revaluation surpluses on PPE.

Conclusion

Whilst the IASB has not yet determined which approach will be adopted, its chairman Hans Hoogervorst has gone on the record as saying ‘It is absolutely vital that the P/L contains all information that can be relevant to investors and that nothing of importance gets left out… and… the IASB should be very disciplined in its use of OCI as resorting to OCI too easily would undermine the credibility of net income so the OCI should only be used as an instrument of last resort’. Now that sounds like a personal endorsement of the narrow approach to me!

Tom Clendon is a lecturer at FTMS based in Singapore and is the author of the second edition of A Student's Guide to Group Accounts (published by Kaplan Publishing)

Copyright © 2000 - www.chinaacc.com All Rights Reserved. 北京正保会计科技有限公司 版权所有

京B2-20200959 京ICP备20012371号-7 出版物经营许可证 ![]() 京公网安备 11010802044457号

京公网安备 11010802044457号

套餐D大额券

¥

去使用