扫码下载APP

及时接收最新考试资讯及

备考信息

Clark Co. had the following transactions with affiliated parties during Year 1:

• Sales of $60,000 to Dean, Inc., with $20,000 gross profit. Dean had $15,000 of inventory on hand at year-end. Clark owns a 15% interest in Dean and does not exert significant influence.

• Purchases of raw materials totaling $240,000 from Kent Corp., a wholly-owned subsidiary. Kent's gross profit on the sale was $48,000. Clark had $60,000 of this inventory remaining on December 31, Year 1.

Before eliminating entries, Clark had consolidated current assets of $320,000. What amount should Clark report in its December 31, Year 1, consolidated balance sheet for current assets?

a. $317,000

b. $303,000

c. $308,000

d. $320,000

Explanation

Choice "c" is correct, $308,000 current assets in the 12/31/Year 1 consolidated balance sheet ($320,000 less 12,000 unrealized profit in inventory)

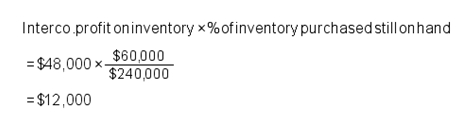

The unrealized profit to be eliminated from inventory is calculated as follows:

Note: No elimination is made related to the transaction with Dean, Inc. because Dean (owned less than 50%) is not consolidated.

上一篇:What is the IQEX

Copyright © 2000 - www.chinaacc.com All Rights Reserved. 北京正保会计科技有限公司 版权所有

京B2-20200959 京ICP备20012371号-7 出版物经营许可证 ![]() 京公网安备 11010802044457号

京公网安备 11010802044457号

套餐D大额券

¥

去使用