扫码下载APP

及时接收最新考试资讯及

备考信息

Baker, a sole proprietor CPA, has several clients that do business in Spain. While on a four-week vacation in Spain, Baker took a five-day seminar on Spanish business practices that cost $800. Baker's round-trip airfare to Spain was $500. While in Spain, Baker spent an average of $100 per day on accommodations, local travel, and other incidental expenses, for total expenses of $3,000. What amount of total expense can Baker deduct on Form 1040 Schedule C, “Profit or Loss From Business,” related to this situation?

A. $4,800

B. $1,300

C. $1,800

D. $800

【答案解析】B

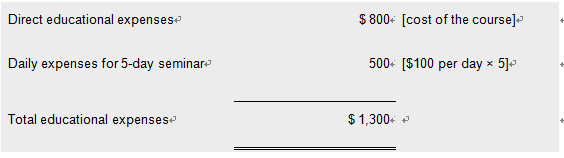

Choice "b" is correct. Baker can deduct $1,300 in total expense on Form 1040 Schedule C, calculated as follows:

Rule: If foreign travel is primarily for personal in nature (e.g., a vacation), none of the travel expenses (e.g., round trip airfare) incurred will be allowable business deductions, even if the taxpayer was involved in business activities while in the foreign country.

Note: It does not appear that the examiners are attempting to trick candidates on the classification of the business expenses as travel or educational. It appears that the purpose of the question is to test the candidate's ability to recognize when expenses are deductible and when they are not deductible business expenses.

Choice "d" is incorrect, as the expenses for the 5-day period Baker attended the seminar were directly related to being in Spain for the additional period of time and are allowable business deductions.

Choices "c" and "a" are incorrect, per the above rule.

下一篇:AUD备考中要牢记审计意见

Copyright © 2000 - www.chinaacc.com All Rights Reserved. 北京正保会计科技有限公司 版权所有

京B2-20200959 京ICP备20012371号-7 出版物经营许可证 ![]() 京公网安备 11010802044457号

京公网安备 11010802044457号