扫码下载APP

及时接收考试资讯及

备考信息

This article looks at the various methods of re-apportioning service cost centre costs

When calculating unit costs under absorption costing principles each cost unit is charged with its direct costs and an appropriate share of the organisation’s total overheads (indirect costs). An appropriate share means an amount that reflects the time and effort that has gone into producing the cost unit.

Service cost centres are those that exist to provide services to other cost centres in the organisation. They do not work directly on producing the final product. Consequently, their costs must be re-apportioned to production cost centres so that their overheads can be absorbed into the final product. This article looks at the various methods of re-apportioning service cost centre costs.

THE DIRECT METHOD

This is the simplest method and is ideal to use when service cost centres provide services to production cost centres, but not to each other. Example 1 considers such a situation.

Example 1

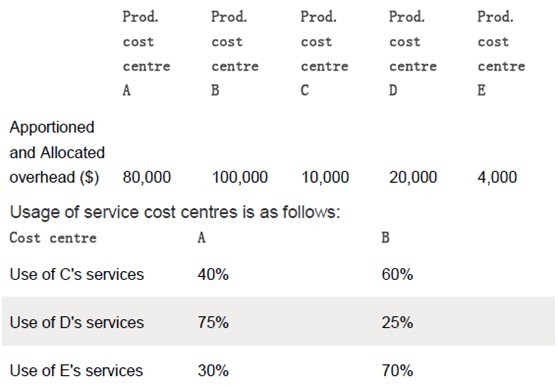

A company’s overheads have been allocated and apportioned to its four cost centres as shown below.

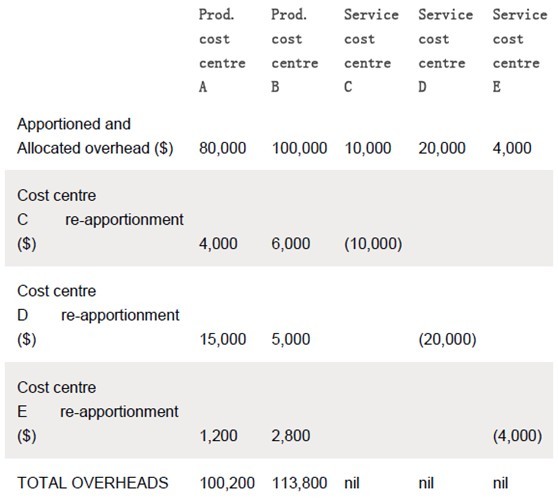

In this situation, service cost centre overheads are simply ‘shared out’ on the basis of usage. For example, production cost centre A should be charged with 40%, 75% and 30% respectively of cost centre C and D and E’s overhead costs. This would result in the following re-apportionment.

Tip: To check that you have not made any arithmetic errors, check that overhead ‘going in’ ($80,000 + $100,000+ $10,000 + $20,000 +$4,000 = $214,000) equals overhead ‘going out’ ($100,200 + $113,800 =$214,000)

THE STEP DOWN METHOD

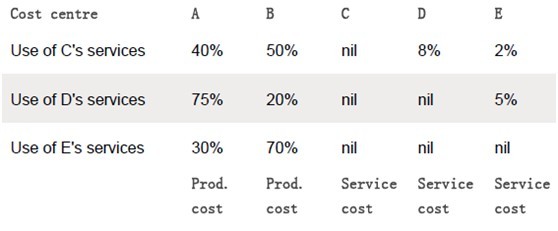

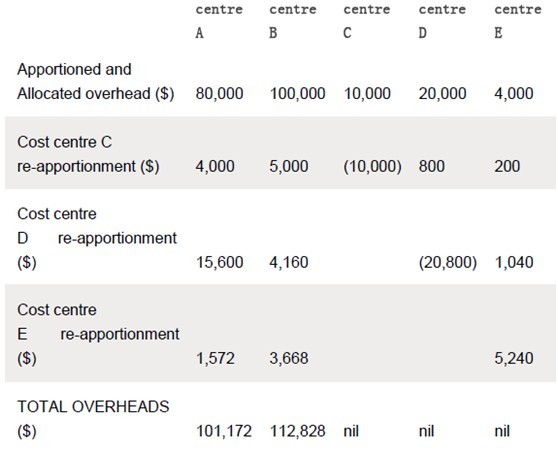

This approach is best used where some service cost centres provide services to other service cost centres, but these services are not reciprocated. Example 2 considers this situation. Cost centre C serves centres D and E, but D and E do not reciprocate by serving C. In these circumstances the costs of the service cost centre that serves most other service cost centres should be reapportioned first. We then ‘step down’ to the service cost centre that provides the second most service, and so on.

Example 2

Data as Example 1 apart from usage of C, D and E’s services has changed. Usage of service cost centres is as follows:

Copyright © 2000 - www.chinaacc.com All Rights Reserved. 北京正保会计科技有限公司 版权所有

京B2-20200959 京ICP备20012371号-7 出版物经营许可证 ![]() 京公网安备 11010802044457号

京公网安备 11010802044457号

套餐D大额券

¥

去使用