扫码下载APP

及时接收考试资讯及

备考信息

Illustration (5)

Red Co acquired 80% of Blue Co’s 40,000 $1 ordinary share capital on 1 January 2012 for a consideration of $3.50 cash per share.

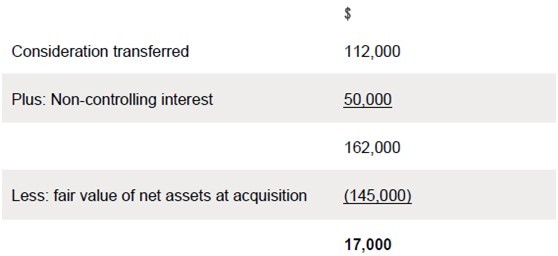

The fair value of the non-controlling interest was $50,000 and the fair value of the net assets acquired was $145,000.

What should be recorded as goodwill on acquisition of Blue Co in the consolidated financial statements?

A $17,000

B $45,000

C $46,000

D $112,000

Answer

Goodwill can be tested in a variety of different ways. Always start by reading the question requirement carefully to determine what is being asked for. Here, in this specific question, it is the goodwill on acquisition that is being asked for, whereas other questions may ask for the cost of investment that would be recorded in the parent’s books.

If we consider each component in turn, the first thing to identify is how much the parent company has paid to acquire control over the subsidiary. In this question, Red Co acquires control by paying $3.50 cash per share.

Remember: Red Co has only acquired 80% of Blue Co’s shares, so consideration transferred is 80% x 40,000 = 32,000 x $3.50 = $112,000.

Had the question asked for the cost of the investment that would be recorded in the parent’s books this would be it – hence the inclusion of the distracter, the incorrect answer D.

Secondly, once we have identified the amount of consideration transferred to acquire control over the subsidiary, the fair value of the non-controlling interest needs to be identified. In this question the fair value of the non-controlling interest is given, so in our calculation we just need to add it to the consideration transferred.

In the final part of the calculation, following on from the point just made, it is necessary to look at all (100%) of the fair value of net assets at acquisition. Again this figure is given in this question and just requires slotting into our goodwill working. In other MCQs, you may be expected to do more work on finding the fair value of the net assets at acquisition.

Goodwill can then be calculated as:

The correct answer is A.

Note: Answer B ignores that Red Co only acquired 80% of the shares and calculates the cost of investment incorrectly as 40,000 x $3.50 = $140,000 – therefore, goodwill of $140,000 + $50,000 – $145,000 = $45,000.

Answer C is incorrect as, despite calculating the cost of investment correctly as $112,000 + non controlling interest of $50,000 = $162,000, it incorrectly deducts (80% x $145,000) as the share of net assets at acquisition giving goodwill of $46,000.

(5) What is an associate and how does equity accounting work?

We began this article with consideration of how to identify a subsidiary, and we conclude it with consideration of a relationship between a parent and an associate.

The Paper F3 syllabus is limited to the definition and identification of an associate and describing the principle of equity accounting only.

An associate is defined by IAS 28, Investments in Associates as ‘an entity over which the investor has significant influence’.

Significant influence is the power to participate in the financial and operating policy decisions of the investee but is not control over those policies.

IAS 28 also states that a holding between 20% and 50% of the ordinary (equity) shares can be presumed to give the investor significant influence unless it can be demonstrated otherwise.

Conversely, significant influence can still be demonstrated where less than 20% of the voting rights are obtained, usually evidenced by:

· representation on the board of directors of the investee

· participation in the policy-making process

· material transactions between the investor and investee

· interchange of management personnel

· provision of essential technical information.

Once we have identified an associate exists, we do not consolidate line by line like we do for a subsidiary (neither do we calculate goodwill). This is simply because we do not have control.

For an associate we have to equity account, which means we simply bring in our share of the associate’s results. In the consolidated income statement, any dividend income received from the associate is replaced by bringing in one line that shows the parent’s share of the associate’s profit.

In the consolidated statement of financial position, the investment in the associate is shown as a single figure in non-current assets. It is calculated as the cost of the investment + parents share of post-acquisition retained profits (ie the profits the associate has earned since the parent has had significant influence).

Illustration (6)

Which of the following investments owned by Indigo Co should be equity accounted in the consolidated financial statements?

· 30% of the non-voting preference share capital in Yellow Co

· 18% of the ordinary share capital in Blue Co with directors of Indigo Co having two of the five places on the board of Blue Co

· 45% of the ordinary share capital of Red Co, with directors of Indigo Co having four of the six places on the board of Red Co

A 1 and 2

B 2 only

C 1 and 3 only

D 2 and 3 only

Answer

Statement (1): Although a 30% holding appears to fall within the 20–50% range, it is a 30% holding in non-voting preference share capital. These do not give Indigo Co

significant influence over Yellow Co and, therefore, Yellow Co is not an associate and would not be equity accounted.

Statement (2): Despite only 18% of the ordinary share capital being held by Indigo Co, as we have already discussed, we do not just consider the percentage of equity shares held, but also look at whether there can be an exercise of significant influence. Having two out of the five directors effectively gives Indigo Co influence, but not control, over decision making in the company and, therefore, Blue Co is an associate and would be equity accounted.

Statement (3): Don’t just look at the 45% holding and presume it is an associate without considering the other facts. By looking at the ability to appoint directors shows that Indigo Co has four of the six directors, effectively giving them control over the decision making in the company. Having control should make you spot that actually Red Co is a subsidiary and, therefore, would be consolidated line by line in the group accounts and would not be equity accounted.

Therefore, the correct answer is B – Statement 2 only.

(6) Concluding exam tips

Remember that at Paper F3/FFA, despite the current exam format testing MCQ only, a good solid platform of understanding the principles of consolidation is required.

Although you are only being asked for extracts and calculations of typically one figure, learning standard consolidation workings can help with your exam approach.

Practising full length consolidation questions will help you grasp a better understanding of consolidation. It is important to understand how each calculation fits into the consolidated financial statement, and this will also benefit your future studies when you revisit consolidation in your later Paper F7 and Paper P2 studies.

When answering MCQs, remember to:

· read the questions requirement carefully and understand what is being asked for

· think about relevant consolidation workings or extracts that may help you

· calculate what you think the correct figure is before you look at MCQ answer options – be careful not to let the distracters catch you out, so think carefully about your calculation

· re-read the question to ensure you understand it and check you are answering the question set if your initial calculation does not match any of the answer options.

Written by a member of the Paper F3/FFA examining team

Copyright © 2000 - www.chinaacc.com All Rights Reserved. 北京正保会计科技有限公司 版权所有

京B2-20200959 京ICP备20012371号-7 出版物经营许可证 ![]() 京公网安备 11010802044457号

京公网安备 11010802044457号

套餐D大额券

¥

去使用