扫码下载APP

及时接收考试资讯及

备考信息

正保会计网校每日为学员更新一道近五次考试的试题,希望在考试即将到来之际,帮助学员查漏补缺、巩固学过的知识点,预祝考生在考场上发挥自如。

问题:

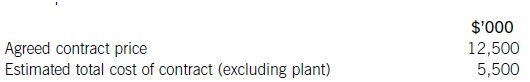

On 1 October 2009 Mocca entered into a construction contract that was expected to take 27 months and therefore be completed on 31 December 2011. Details of the contract are:

Plant for use on the contract was purchased on 1 January 2010 (three months into the contract as it was not required at the start) at a cost of $8 million. The plant has a four-year life and after two years, when the contract is complete, it will be transferred to another contract at its carrying amount. Annual depreciation is calculated using the straight-line method (assuming a nil residual value) and charged to the contract on a monthly basis at 1/12 of the annual charge.

The correctly reported income statement results for the contract for the year ended 31 March 2010 were:

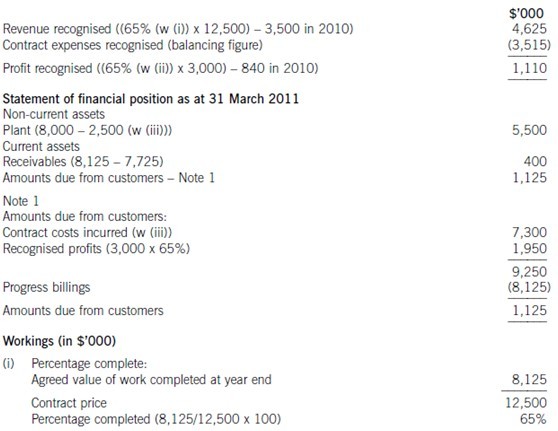

The percentage of completion is calculated as the agreed value of work completed as a percentage of the agreed contract price.

Required:

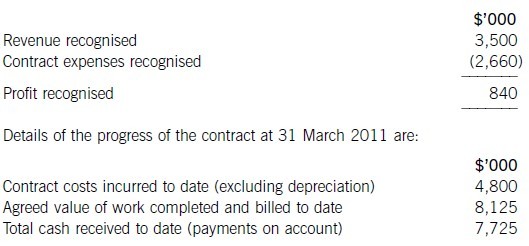

Calculate the amounts which would appear in the income statement and statement of financial position of Mocca, including the disclosure note of amounts due to/from customers, for the year ended/as at 31 March 2011 in respect of the above contract.

(10 marks)

Answer:

Mocca

Income statement year ended 31 March 2011

Copyright © 2000 - www.chinaacc.com All Rights Reserved. 北京正保会计科技有限公司 版权所有

京B2-20200959 京ICP备20012371号-7 出版物经营许可证 ![]() 京公网安备 11010802044457号

京公网安备 11010802044457号

套餐D大额券

¥

去使用