扫码下载APP

及时接收考试资讯及

备考信息

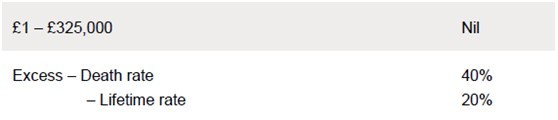

Rates of tax

IHT is payable once a person’s cumulative chargeable transfers over a seven-year period exceed a nil rate band. For the tax year 2012–13 the nil rate band is £325,000, and for previous years it has been as follows:

The rate of IHT payable as a result of a person’s death is 40%. This is the rate that is charged on a person’s estate at death, on PETs that become chargeable as a result of death within seven years, and is also the rate used to see if any additional tax is payable on CLTs made within seven years of death.

The rate of IHT payable on CLTs at the time they are made is 20% (half the death rate). This is the lifetime rate.

The tax rates information that will be given in the tax rates and allowances section of the June and December 2013 exam papers is as follows:

Where nil rate bands are required for previous years then these will be given to you within the question.

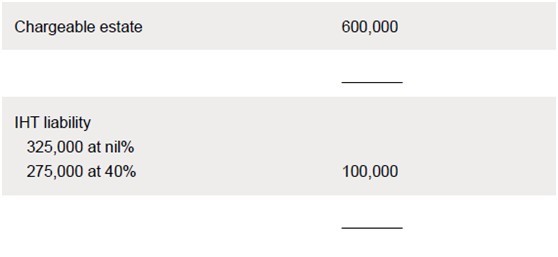

Example 4

Sophie died on 26 May 2012 leaving an estate valued at £600,000.

The IHT liability is as follows:

Death estate

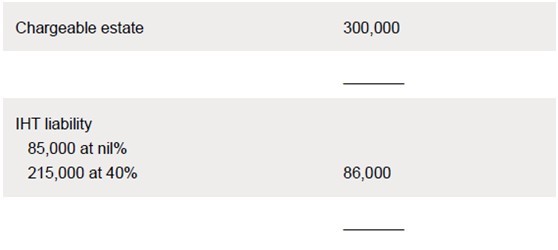

Example 5

Ming died on 22 April 2012 leaving an estate valued at £300,000.

On 30 April 2010 she had made a gift of £240,000 to her son. This figure is after deducting available exemptions.

IHT liabilities are as follows:

Lifetime transfer – 30 April 2010

· Only £85,000 (325,000 – 240,000) of the nil rate band is available against the death estate.

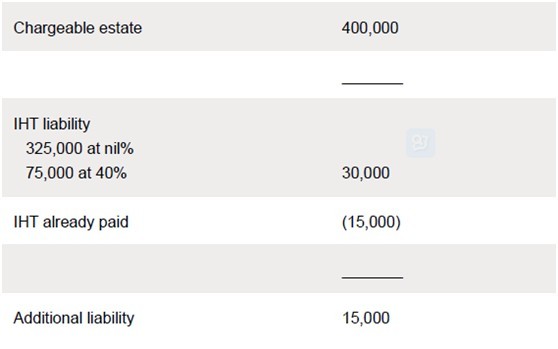

Example 6

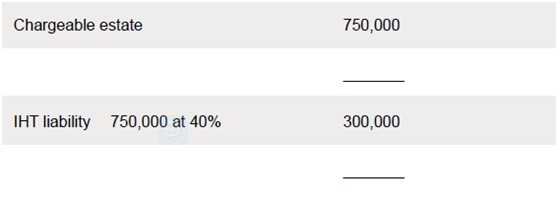

Joe died on 13 October 2012 leaving an estate valued at £750,000.

On 12 November 2009 he had made a gift of £400,000 to a trust. This figure is after deducting available exemptions. The trust paid the IHT arising from the gift.

The nil rate band for the tax year 2009–10 is £325,000.

Lifetime transfer – 12 November 2009

· The gift to a trust is a CLT. The lifetime IHT liability is calculated using the nil rate band for 2009–10.

Additional liability arising on death – 12 November 2009

· The additional liability arising on death is calculated using the nil rate band for 2012–13.

Death estate

· The CLT made on 12 November 2008 has fully utilised the nil rate band of £325,000.

Page:1 2 See the original>>

Copyright © 2000 - www.chinaacc.com All Rights Reserved. 北京正保会计科技有限公司 版权所有

京B2-20200959 京ICP备20012371号-7 出版物经营许可证 ![]() 京公网安备 11010802044457号

京公网安备 11010802044457号