扫码下载APP

及时接收考试资讯及

备考信息

How to account for property in Hong Kong

This article is applicable to any candidate studying for F7, P2 or DipIFR

With very few exceptions, all land in Hong Kong is owned by the Government and leased out for a limited period. It does not matter if the properties are high-rise buildings, residential, offices or factories, they are built on land under a government lease.

Developers of these properties lease lots of land from the Government and develop the land according to the lease conditions, such as to construct buildings on the land according to the specifications within a specified period.

Individual units of these lots of land and buildings are usually sold as undivided shares in the lots. Interests of all parties, including future buyers of the units, are governed by the deeds of mutual covenant.

In substance and in form, ‘owners‘ of these units are a lessee of a lease of land and buildings. According to IFRS, the land and buildings elements of these leases should be considered separately for the purposes of lease classification under IAS 17.

Allocation of the interests in leases of land and building

IAS 17

When a lease includes both land and buildings elements, we should assess the classification of each element as a finance or an operating lease separately.

(Except, if the amount that would initially be recognised for the land element is immaterial, the land and buildings may be treated as a single unit for the purpose of lease classification. In such a case, the economic life of the buildings is regarded as the economic life of the entire leased asset.)

In determining whether the land element is an operating or a finance lease, an important consideration is that land normally has an indefinite economic life, which makes most of the land elements operating leases.

However, this is not always the case. Land elements can be classified as a finance lease if significant risks and rewards associated with the land during the lease period would have been transferred from the lessor to the lessee despite there being no transfer of title. For example, consider a 999-year lease of land and buildings. In this situation, significant risks and rewards associated with the land during the lease term would have been transferred to the lessee despite there being no transfer of title.

Separate measurement of the land and buildings elements is not required when the lessee’s interest in both land and buildings is classified as an investment property in accordance with IAS 40 and the fair value model is adopted.

Classification as property, plant and equipment or as an investment property

The issue is complicated when the separate elements of the land and buildings are further classified in accordance with IAS 16, Property, Plant and Equipment and IAS 40, Investment Properties.

IAS 16

According to IAS 16, land and buildings are separable assets and are accounted for separately, even when they are acquired together. Land has an unlimited useful life and, therefore, is not depreciated. Buildings have a limited useful life and, therefore, are depreciable assets. An increase in the value of the land on which a building stands does not affect the determination of the depreciable amount of the building.

IAS 40

A property interest that is held by a lessee under an operating lease may be classified and accounted for as investment property provided that:

· the rest of the definition of investment property is met

· the operating lease is accounted for as if it were a finance lease in

accordance with IAS 17, Leases, and

· the lessee uses the fair value model for investment property

The choice between the cost and fair value models is not available to a lessee accounting for a property interest held under an operating lease that it has elected to classify and account for as investment property. The standard requires such investment property to be measured using the fair value model.

IAS 40 depends on IAS 17 for requirements for the classification of leases, the accounting for finance and operating leases and for some of the disclosures relevant to leased investment properties. When a property interest held under an operating lease is classified and accounted for as an investment property,

IAS 40 overrides IAS 17 by requiring that the lease is accounted for as if it were a finance lease.

Scenario summaries

Scenario 1: Long-term lease of land

Land element is classified as a finance lease under IAS 17 as significant risks and rewards associated with the land during the lease period would have been transferred to the lease despite there being no transfer of title.

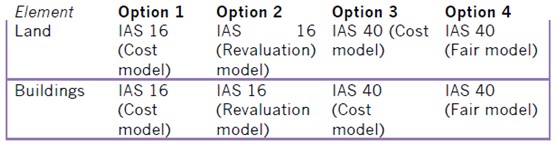

The land should be recognised under IAS 16 (option 1 and 2) if it is owner-occupied or under IAS 40 (option 3 and 4) if it is used for rental earned.

Option 1: Both land and buildings elements are measured at cost and presented under Property, Plant and Equipment in the statement of financial position. No depreciation is required for the land element but it is required for the buildings element.

Option 2: Both land and buildings elements are measured at fair value with changes being posted to equity and presented under Property, Plant and Equipment in the statement of financial position. No depreciation is required for the land element but it is required for the buildings element.

Option 3: Both land and buildings elements are measured at cost and presented under investment property in the statement of financial position. No depreciation is required for the land element but is required for the buildings element.

Option 4: Both land and buildings elements are measured at fair value and presented under investment property in the statement of financial position. No depreciation is required for either the land element or buildings element.

Scenario 2: Short-term lease of land

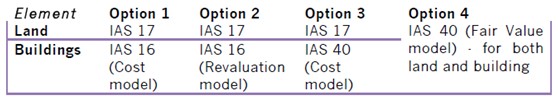

Land element is classified as an operating lease under IAS 17 because it has indefinite economic life.

The land element should be recognised under IAS 17, as prepaid lease payments that are amortised over the lease term. Except for, it can be classified as investment property and the fair value model is used (option 4)

The buildings element should be recognised under IAS 16 (option 1 and 2) if it is owner occupied or under IAS 40 (option 3 and 4) if it is used for rental earned.

Option 1: Land element is measured as prepaid lease payments that are

amortised over the lease term. While the buildings element is measured at cost and presented under Property, Plant and Equipment in the statement of financial position. Depreciation is required for the building element.

Option 2: Land element is measured as prepaid lease payments that are

amortised over the lease term. While the buildings element is measured at fair value with changes being posted to equity and presented under Property, Plant and Equipment in the statement of financial position. Depreciation is required for the building element.

Option 3: Land element is measured as prepaid lease payments that are

amortised over the lease term. While the buildings element is measured at cost and presented under Investment property in the statement of financial position. Depreciation is required for buildings element.

Option 4: Both land and buildings elements are measured at fair value and presented under Investment property in the statement of financial position. No depreciation is required for the land element and buildings element.

Scenario 3: Land element is immaterial

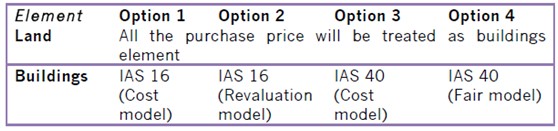

As the land element is immaterial, the land and buildings elements are treated as a single unit for the purpose of lease classification. The economic life of the buildings is regarded as the economic life of the entire leased property.

Option 1: Property is measured at cost and presented under Property, Plant and Equipment in the statement of financial position. Depreciation is required.

Option 2: Property is measured at fair value with change being posted to equity and presented under Property, Plant and Equipment in the statement of financial position. Depreciation is required.

Option 3: Property is measured at cost and presented under Investment property in the statement of financial position. Depreciation is required.

Option 4: Property is measured at fair value and presented under Investment property in the statement of financial position. No depreciation is required.

Impairment review under IAS 36 is required to all assets at the reporting date except for those where the fair value model is adopted.

Linda Ng, HKCA Learning Media

Copyright © 2000 - www.chinaacc.com All Rights Reserved. 北京正保会计科技有限公司 版权所有

京B2-20200959 京ICP备20012371号-7 出版物经营许可证 ![]() 京公网安备 11010802044457号

京公网安备 11010802044457号