扫码下载APP

及时接收考试资讯及

备考信息

Trevor is employed by C plc at a salary of £25,000 a year. He is provided with a car available for private use for the tax year 2015/16. The car has CO2 emissions of 128 g/km and a list price of USD20,000 although C plc actually paid £18,000 for the car as the result of a dealer discount. The car has a diesel engine. No private fuel is provided.

What is Trevor's taxable car benefit for the tax year 2015/16?

A £3,600

B £4,140

C £4,000

D £4,600

解析:

本题是求taxable car benefit的金额,也就是应纳税的车辆福利。

本题涉及的知识点具体位于咱们ACCA BPP教材的第四章3.3小节,在第40页。

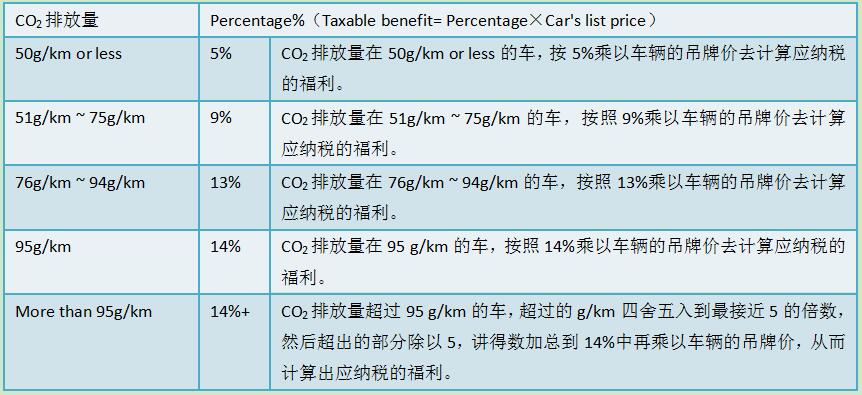

首先题目条件中指出了是公司提供给Trevor私人使用(private use)的。所以咱们有一个规则:The percentage of the list price that is taxable depends on the car's CO2 emissions. 这部分知识点在教材的60页3.3.1小节。具体的计算规则在3.3.2小节,如下:

For cars that emit CO2 of 50g/km or less, the 95g/km is 5% of the car's list price.

For cars that emit CO2 between 51g/km and 75g/km, the taxable benefit is 9% of the car's list price.

For cars that emit CO2 between 76g/km and 94g/km, the taxable benefit is 13% of the car's list price.

For cars that emit CO2 of 95g/km, the taxable benefit is 14% of the car's list price.

This percentage increases by 1% for every 5g/km (rounded down to the nearest multiple of 5) by which CO2 emissions exceed 95g/km up to a maximum of 37%.

具体的计算规则是:

例如:96g/km的车,超过了95g/km,四舍五入到至接近5的倍数还是95g/km,所以14%。如果是134 g/km,超过了95g/km,四舍五入到至接近5的倍数是130,然后超出95g/km的部分35除以5等于7,所以7+14%=22%。

但是至多到37%的比例,超过的就不算了。

注意咱们税法规定中还有一点:

Diesel cars have a supplement of 3% of the car's list price added to the taxable benefit. The maximum percentage, however, remains 37% of the list price.

所以对于本题来说:

128 g/km:(128 - 95)÷ 5 约等于 6,所以6 + 14% = 20%+3%=23%

所以答案=23%×USD20,000(list price)= USD 4,600

答案选择:D

Copyright © 2000 - www.chinaacc.com All Rights Reserved. 北京正保会计科技有限公司 版权所有

京B2-20200959 京ICP备20012371号-7 出版物经营许可证 ![]() 京公网安备 11010802044457号

京公网安备 11010802044457号

套餐D大额券

¥

去使用