扫码下载APP

及时接收考试资讯及

备考信息

考官报告是至直观了解ACCA考试考情分析的途径之一,因为它是由ACCA判卷人根据每次考生的答题情况直接撰写的。考官会针对一些难点题目,或者考生普遍出错的题目做出详细的分析。

之后准备考试的考生也可以通过阅读ACCA考官报告,避免一些不必要的失误。

下面我们就一起看看在2017年6月 F2《管理会计》的考官报告中,考官都说了些什么。

General Comments

The examination consists of two sections. Section A of the paper contains 35 objective test questions – each worth 2 marks, and section B contains 3 MTQs worth ten marks each. All questions are compulsory. The paper is a two hour examination. A pilot paper reflecting this structure is available on the ACCA website together with a number of practice MTQs.

As always, excellent scores were achieved by some candidates. I congratulate both them and their teachers. I offer my commiserations to those who were not successful.

In section A the worst answered MCQ questions were calculation based. Calculation questions account for approximately 45% of section A questions, and as usual were answered worse than the narrative based MCQs. Eight out of the 10 worst answered section A questions were calculation based.

In section B approximately one half of the marks are for calculation. There was little difference in performance between section B calculation and narrative questions. However there was some evidence that candidates performed worse on section B MTQ questions than on section A objective test questions.

The following questions from section A of the paper are ones where the performance of candidates was very weak.

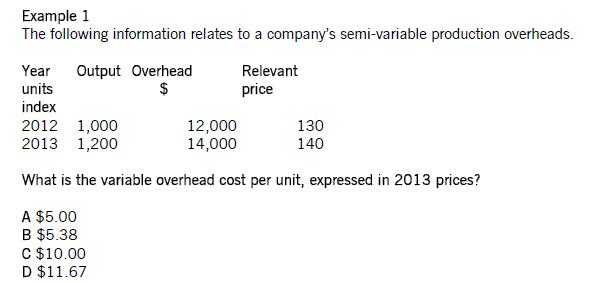

This question required candidates to use the high low technique (syllabus area A3b) and a knowledge of price indices (syllabus area C2n) to calculate a variable cost per unit.

The correct answer is B, chosen by only a small minority of candidates. To arrive at this answer candidates needed to firstly use the price index data to express the 2012 overhead cost in 2013 prices ($12,000 x140/130 = $12,923). Then they needed to use the high low method to calculate variable cost per unit. (($14,000 - $12,923)/(1,200 units – 1,000 units) = $5.38).

Alternative C was the most popular choice by candidates. This answer is the result of using the high low technique with no adjustment for inflation (($14,000 - $12,000)/(1,200 units – 1,000 units) = $10.00). Candidates need to be aware that inflation can distort historic cost data, and that data may need to be adjusted before applying techniques such as high low or regression analysis.

Alternative A was the next most popular answer. Candidates who selected this alternative could correctly apply the high low technique, and were aware that the price index needed to be used to remove the effect of inflation.

Unfortunately they expressed the cost data in 2012 prices, effectively providing the correct answer to a different question. Their calculations were as follows. Firstly they expressed the 2013 cost in 2012 prices ($14,000 x130/140 = $13,000). Then they used the high low method (($14,000 - $13,000)/(1,200 units – 1,000 units)= $5.00).

Alternative D was selected by a number of candidates. Candidates who chose this alternative simply divided $14,000 by 1,200 units and calculated an average unit cost for 2013 of $11.67. This was the “most incorrect”answer and demonstrates a failure to understand the difference between average cost and variable cost per unit.

点击查看ACCA F2 2017 January to June 考官报告全文>>

ACCA 2017年12月考试正在紧张备考中,中华会计网校为广大学员准备了丰富的复习资料,助力同学们顺利通过12月考试!

Copyright © 2000 - www.chinaacc.com All Rights Reserved. 北京正保会计科技有限公司 版权所有

京B2-20200959 京ICP备20012371号-7 出版物经营许可证 ![]() 京公网安备 11010802044457号

京公网安备 11010802044457号

套餐D大额券

¥

去使用