扫码下载APP

及时接收考试资讯及

备考信息

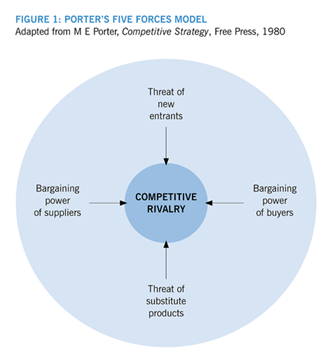

波特五力模型是迈克尔·波特(Michael Porter)于20世纪80年代初提出,它认为行业中存在着决定竞争规模和程度的五种力量,这五种力量综合起来影响着产业的吸引力以及现有企业的竞争战略决策。五种力量分别为同行业内现有竞争者的竞争能力、潜在竞争者进入的能力、替代品的替代能力、供应商的讨价还价能力、购买者的讨价还价能力。

The model has similarities with other tools for environmental audit, such as political, economic, social, and technological (PEST) analysis, but should be used at the level of the strategic business unit, rather than the organisation as a whole. A strategic business unit (SBU) is a part of an organisation for which there is a distinct external market for goods or services. SBUs are diverse in their operations and markets so the impact of competitive forces may be different for each one.

Five forces analysis focuses on five key areas: the threat of entry, the power of buyers, the power of suppliers, the threat of substitutes, and competitive rivalry.

THE THREAT OF ENTRY

This depends on the extent to which there are barriers to entry. These barriers must be overcome by new entrants if they are to compete successfully. Johnson et al (2005), suggest that the existence of such barriers should be viewed as delaying entry and not permanently stopping potential entrants. Typical barriers are detailed below.

Economies of scale

For example, the benefits associated with volume manufacturing by organisations operating in the automobile and chemical industries. Lower unit costs result from increased output, thereby placing potential entrants at a considerable cost disadvantage unless they can immediately establish operations on a scale that will enable them to derive similar economies.

The capital requirement of entry

These vary according to technology and scale. Certain industries, especially those which are capital intensive and/or require very large amounts of research and development expenditure, will deter all but the largest of new companies from entering the market.

Access to supply or distribution channels

In many industries, manufacturers enjoy control over supply and/or distribution channels via direct ownership (vertical integration) or, quite simply, supplier or customer loyalty. Potential market entrants may be frustrated by not being able to get their products accepted by those individuals who decide which products gain shelf or floor space in retailing outlets. Retail space is always at a premium and untried products from a new supplier constitute an additional risk for the retailer.

Supplier and customer loyalty

A potential entrant will find it difficult to gain entry to an industry where there are one or more established operators with a comprehensive knowledge of the industry, and with close links with key suppliers and customers.

Cost disadvantages independent of scale

Well-established companies may possess cost advantages which are not available to potential entrants irrespective of their size and cost structure. Critical factors include proprietary product technology, personal contacts, favourable business locations, learning curve effects, favourable access to sources of raw materials, and government subsidies.

Expected retaliation

In some circumstances, a potential entrant may expect a high level of retaliation from an existing firm, designed to prevent entry – or make the costs of entry prohibitive.

Government regulation

This may prevent companies from entering into direct competition with nationalised industries. In other scenarios, the existence of patents and copyrights afford some degree of protection against new entrants.

Differentiation

Differentiated products and services have a higher perceived value than those offered by competitors. Products may be differentiated in terms of price, quality, brand image, functionality, exclusivity, and so on. However, differentiation may be eroded if competitors can imitate the product or service being offered and/or reduce customer loyalty.

Copyright © 2000 - www.chinaacc.com All Rights Reserved. 北京正保会计科技有限公司 版权所有

京B2-20200959 京ICP备20012371号-7 出版物经营许可证 ![]() 京公网安备 11010802044457号

京公网安备 11010802044457号

套餐D大额券

¥

去使用