扫码下载APP

及时接收考试资讯及

备考信息

Bad/Irrecoverable debts坏账

坏账是指企业无法收回或收回的可能性极小的应收款项。由于发生坏账而产生的损失,称为坏账损失。可能发生坏账的情况有以下几种:

Indicators that a debt may become irrecoverable include:

l Taking longer to pay than is usual.

l Paying in instalments outside normal credit terms.

l Regular disputing of invoices (as a delaying tactic).

l Going into receivership (administration)/liquidation.

当顾客没有能力支付时,就没必要一直保留的这笔账目,相关会计处理如下:

When a business is owed money by a customer who is unable to pay, there is little point keeping the customer's account in the business' books.

l If the debt is not an asset, then it should not be carried in the statement of financial position.

l To give a fair presentation in the accounts, irrecoverable debts are written out of the books and expensed to profit or loss, thereby reducing profit (or increasing a loss).

l The double entry to record the write-off is:

Dr Irrecoverable debt expense a/c $x

Doubtful Debts疑账

疑账是指对其内容或清偿能力有怀疑的账户,它有可能变成坏账,但目前还不是坏账。

Eventually, a firm may have to admit defeat and write off the account receivable.

It is unnecessary to match the write-off with the allowance made.

Simply:

Dr Irrecoverable debt expense a/c $x

Cr Trade receivable a/c $x

(i.e. as for any irrecoverable debt)

The debit for irrecoverable debt expense does not result in a double charge to profit or loss. The specific allowance previously made is no longer required and will be set off against the write-off when the movement on the allowance is transferred to the irrecoverable debt expense a/c.

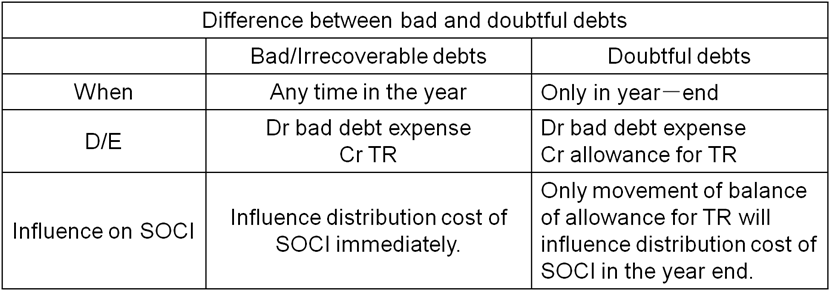

坏账与疑账的区别:

Copyright © 2000 - www.chinaacc.com All Rights Reserved. 北京正保会计科技有限公司 版权所有

京B2-20200959 京ICP备20012371号-7 出版物经营许可证 ![]() 京公网安备 11010802044457号

京公网安备 11010802044457号

套餐D大额券

¥

去使用