扫码下载APP

及时接收考试资讯及

备考信息

ACCA官网已公布2016年ACCA试题,网校特别为大家整理以下试题,希望能够帮助您查漏补缺、巩固知识点,在考场上发挥自如.

Question:

(a)Mrs Li had the following sources of income in the year 2015:

(1)She won a prize of RMB876,000 from the Sports Lottery.

(2)She received an insurance compensation of RMB60,000 from a medical and life policy. She had paid a premium of RMB40,000 for this policy.

(3)She placed RMB150,000 on a time deposit account with a bank for six months and received interest at the rate of 6% per annum.

(4)She received a villa from her husband as part of their divorce settlement. The villa had cost RMB5,000,000 and is currently valued at RMB9,500,000.

(5)She had invested in SH Petro, an A-share listed company, in 2010 and in October 2015 received a dividend of RMB5,000 from this company.

(6)She sold the shares in her personal company to a foreign investor and received RMB8,000,000 for agreeing not to compete in the same business for three years.

Required:

Calculate the individual income tax (IIT)payable by Mrs Li on each of her items of income (1)to (6)for 2015. Clearly identify any item(s)which are not taxable as either 'tax exempt' or 'not subject to IIT'.

Note: Ignore value added tax and business tax.

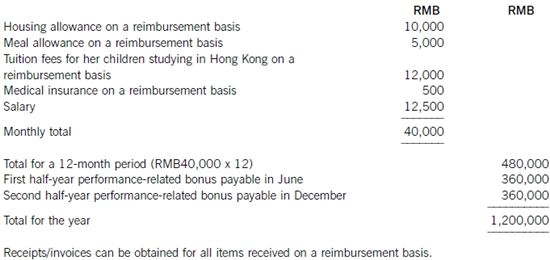

(b)Ms Wu is an expatriate working and living in Guangzhou. Her remuneration package for 2015 is as follows:

Required:

Calculate the total individual income tax (IIT)payable by Ms Wu on her employment income for 2015 on the assumption that Ms Wu qualifies for all possible tax incentives allowable under the IIT rules.

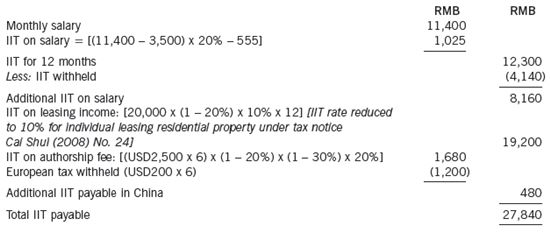

(c)Mr Huang is a China tax resident who has to file an annual individual income tax (IIT)return for 2015. His income and IIT withholding status for 2015 are as follows:

Required:

Calculate the individual income tax (IIT)which Mr Huang has to pay on filing his annual IIT return for 2015.

Note: Because the rental income is less than RMB30,000 per month it is exempt from value added tax/business tax.

Answer:

(a)Mrs Li - Individual income tax (IIT)for 2015

(1)Sports lottery prize: (876,000 x 20%)= RMB175,200

Tutorial note: A prize of RMB10,000 or less is exempt from IIT.

(2)Insurance compensation: exempt from IIT. [Article 4, IIT Law]

(3)Interest on time deposit with a bank: temporarily exempt from IIT.

(4)Villa received from a divorce: not subject to IIT. [Tax notice Guo Shui Fa (2009)No. 121]

(5)Dividend from a listed company on shares held for over one year: temporarily exempt from IIT.

[Tax notice Cai Shui (2015)No. 101]

(6)Non-competition payment: (8,000,000 x 20%)= RMB1,600,000

Tutorial note: Taxed as incidental income according to tax notice Caishui (2007)No. 102.

(b)Ms Wu - IIT on employment income for 2015

Tutorial notes:

- Reasonable amount of housing allowances and meal allowances received on a reimbursement basis by an expatriate are exempt from IIT provided the relevant supporting documents are available.

- Only one bonus can use the special formula to calculate IIT and the other bonuses will be added to the salary of the month to calculate IIT.

- Since Ms Wu lives in Guangzhou, she is not qualified for the tax exemption for tuition fees for her children studying in Hong Kong, based on tax notice Caishui [2004] No. 29.

(c)Mr Huang - IIT on filing the annual return for 2015

扫一扫关注更多ACCA考试资讯

Copyright © 2000 - www.chinaacc.com All Rights Reserved. 北京正保会计科技有限公司 版权所有

京B2-20200959 京ICP备20012371号-7 出版物经营许可证 ![]() 京公网安备 11010802044457号

京公网安备 11010802044457号

套餐D大额券

¥

去使用