扫码下载APP

及时接收最新考试资讯及

备考信息

2018年AICPA考试已经进入第四个考季,为帮助广大学员高效备考,正保会计网校AICPA专业老师特别为学员总结了AICPA考试《财务会计与报告》必考知识点:Income Tax——递延的流入和流出。祝您在网校学习愉快!考试顺利!

背景知识:

税前利润(earnings before income tax):按照US GAAP / IFRS计算出的税前利润。

应税收入(taxable income):遵循美国税法计算得出的应当缴纳所得税的收入,应税收入乘以企业适用税率再扣除所得税抵免项(income tax credit)即可得到本年应交所得税。

美国企业所得税税率为累进税率,即应税收入越高,对应税率就越高,考试中会直接给出适用税率。

税收抵免项(income tax credit)是能够直接减免应交所得税的项目,即(taxable income × tax rate)-income tax credit=income tax payable。此概念在FAR考试中一般不做考察。

应交所得税(income tax payable):按照美国税法计算出的企业本期应交所得税金额。

所得税费用(income tax expense):遵循US GAAP,计算出企业本期营业利润对应的应发生所得税金额,无论该所得税是否在本年缴纳。

由于税法对于应税收入的确认与GAAP/IFRS对于营业利润的确认方法和时点存在差异,因此income tax payable和income tax expense也存在着各种差异。

【例】

① 企业为高管购买的人寿保险,受益人为企业本身,如高管在保险期内去世,则该理赔金收入在财务上确认为收入,在税务上则是免税的,不计入taxable income

② 企业分期付款销售收入,财务上立刻确认为收入,税务上则在收到现金时方才确认taxable income

了解税务收入和财务收入之间的差异,并掌握相关会计核算,是所得税会计部分的主要学习目标。

具体知识点讲解:

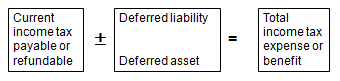

1. Overview

Accounting for income taxes involves both intraperiod and interperiod tax allocation.

所得税会计包含期内所得税分摊(intraperiod)与跨期所得税分摊(interperiod)

1.1 Intraperiod Tax Allocation

所得税会计中将同一期间的所得税费用(而不是该期间应付所得税)分摊于该于期间的损益及其他综合收益构成项目的程序(IDA+PUFER)。简单来说,就是计算每一个net income及OCI项目相关的所得税费用。

1.2 Comprehensive Interperiod Tax Allocation

跨期所得税分摊的目的是将本期应交所得税和未来应交所得税与财务报表上已确认事项匹配起来(matching principle)。实际上,就是指计算并确认递延所得税资产与递延所得税负债。

>>Permanent Differences 永久性差异

Enter into pretax GAAP financial income calculation, but never enter into taxable income calculation, or vice versa (企业作为受益人的高管人寿保险理赔收入)

永久性差异仅影响当期所得税,不影响以后年度

>>Temporary Differences 暂时性差异

Enter into pretax GAAP financial income calculation in a period before/after they enter into taxable income calculation(分期付款销售收入)

Comprehensive Allocation (of income tax expense):The asset and liability method is required by GAAP (ie. record income tax payable or deferred tax asset/liability on the B/S)

考点:Asset and liability method 有时也称为asset and liability approach或 balance sheet approach

Deferred tax asset:递延所得税资产,暂时性差异中能够减少未来期间的应交所得税的金额。如:预收房租的影响

Deferred tax liability:递延所得税负债,暂时性差异中能够增加未来期间的应交所得税的金额。如:分期付款销售的影响

2. Permanent Differences

◆ No Deferred Taxes

◆ Creates difference in current year only

在某一会计期间,税前会计利润与应纳税所得之间由于计算口径不同而形成的差异。这种差异在本期产生,不能在以后各期转回,即不会影响未来期间所得税的计算

Examples:

>>Tax-exempt interest income (municipal, state)

企业购买地方政府债券的利息收入无需缴纳联邦所得税

>> Life insurance proceeds on officer's key man policy

企业作为受益人的高管人寿保险理赔所得免税

>> Life insurance premiums when corporation is beneficiary

企业为高管购买人寿保险,若受益人为企业,则购买该种保险的费用不能税前抵扣

>> Certain penalties, fines, bribes, kickbacks, etc.

罚金,贿赂,回扣等支出不能税前抵扣

>> Nondeductible portion of meal and entertainment expense

普通商业招待费用仅有50%可以税前抵扣

>> Dividends-received deduction for corporations

公司(Corporation)投资其他公司收到的股利中,可以有70% (持有被投资方股份少于20%),80% (持有被投资方股份占20%或以上,小于80%)或100%(持有被投资方股份达到80%或以上)免交所得税

技巧:若在题目中见到 Fortune Global 500,Top 500的字样,说明该企业是购买了世界五百强企业的股票,占股量一定很小,收到股利免税比例一定是70%

>> Excess percentage depletion over cost depletion

百分比折耗法下可抵扣折耗金额超过成本折耗法下可抵扣折耗金额的部分

3. Temporary Differences

Transactions That Cause Temporary Differences:

(Differences can be reversed in subsequent period)

① F/S income first, tax return income later

Tax income later = Future tax liability

1. Installment sales

2. Equity method (undistributed dividends)

② Tax return income first, F/S income later

Tax income first = Prepaid tax benefit (asset)

1. Prepaid rent (received) *

2. Prepaid interest (received) *

3. Prepaid royalties (received) *

* — The IRC uses the term "prepaid," GAAP uses the term "unearned"

③ F/S expense first, tax return expense later

Tax deduct later = Future tax benefit (asset)

1. Bad debt expense (allowance vs. direct write off)

2. Estimated liability / warranty expense

3. Start-up expenses

④ Tax return expense first, F/S expense later

Tax deduct first = Future tax liability

1. Depreciation expense

2. Amortization of franchise

3. Prepaid expenses (cash basis for tax)

Passkey:

▲ DTL→Future taxable income > Future financial income

▲ DTA→Future taxable income < Future financial income

4. Uncertain Tax Positions

不确定的税务状况:企业在经营过程中为了避税,经常会采取一系列以试图避税为目的的措施,由于申报纳税比企业内部会计处理更加滞后,且采取此类措施的企业会倾向于认为该措施能够成功减免所得税,故而这些措施首先会影响企业的日常账务处理和财务报告,之后再影响纳税申报单。

然而,企业所采取的避税措施有可能会被税务局或税务法院裁定为不合理避税措施,这种可能性会使企业面临巨额的税款补缴甚至罚款,也就是说,如果不能正确的在财务报表上反映企业避税措施失败的可能性和相关的金额,就可能导致一些潜在的税务负债不被列报。

由于某些避税活动的实际效果是未知且不确定的,这些避税活动会使企业提交的纳税申报表处于一个不确定的税务状况(Uncertain Tax Positions),这种不确定的状况,可能会给企业带来税务方面的负债。

因此,为了避免不确定税务状况不被记录导致财务报表使用者的决策受到影响,US GAAP规定,企业必须在它们的财务报表上记录不确定税收状况导致的或有损失。

Two-Step Approach:

Step 1: Recognition of the Tax Benefit

Step 2: Measurement of the Tax Benefit

Step 1: Recognition of the Tax Benefit

>>Test “More-Likely-Than-Not”→ 50%

>>Test Failed — do not recognize tax benefit

评估该减税项目被税务局认可(sustain)的可能性

Step 2: Measurement of the Tax Benefit

>>Recognize the largest amount of tax benefit that has a greater than 50 percent likelihood.

>>If the tax position is based on clear and unambiguous tax law, recognize the full benefit.

估计减税项目至终能够抵减税款的金额

5. Enacted Tax Rate

在计算DTA 和DTL的时候,企业需要预估以后年度的税率,至终预计出的适用税率就是Enacted Tax Rate.

6. Balance Sheet Presentation

Under U.S. GAAP, all DTL and DTA must be netted and presented as one amount (a net non-current asset or a net non-current liability), unless the deferred tax liabilities and assets are attributable to different tax-paying components of the entity or to different tax jurisdictions.

丨献给学员:越努力,越幸运!加油!!!

有意向报考的AICPA的考生赶快点击下方按钮进行免费预评估>> 了解AICPA报考条件吧!

Copyright © 2000 - www.chinaacc.com All Rights Reserved. 北京正保会计科技有限公司 版权所有

京B2-20200959 京ICP备20012371号-7 出版物经营许可证 ![]() 京公网安备 11010802044457号

京公网安备 11010802044457号