扫码下载APP

及时接收考试资讯及

备考信息

It is important that Paper F6 (UK) candidates know the group relationship that must exist for reliefs to be available. Working through the examples in this article will prepare you for group-related questions in the exam

This article is relevant to those of you taking Paper F6 (UK) in either the June or December 2013 sittings, and is based on tax legislation as it applies to the tax year 2012–13 (Finance Act 2012).

Groups may be examined as part of Question 2, or they could be examined in Questions 4 or 5.

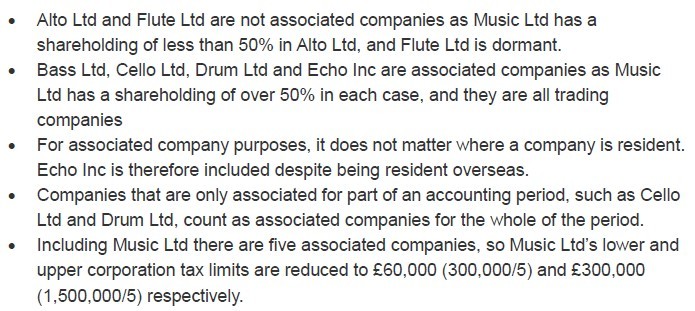

Associated companies A question may require you to identify the number of associated companies in a group, or it may tell you how many associated companies there are and then ask you to justify this number. When answering this type of question make sure you explain why companies are both included and excluded.

The lower and upper corporation tax limits are divided by the number of associated companies, thus affecting the rate of corporation tax. Do not forget to include the parent company in the number of associated companies.

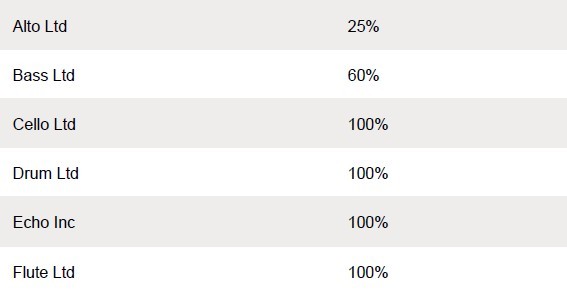

Example 1 Music plc has the following shareholdings:

Example 1

Music plc has the following shareholdings:

Music plc’s shareholding in Cello Ltd was disposed of on 31 December 2012, and the shareholding in Drum Ltd was acquired on 1 January 2013. The other shareholdings were all held throughout the year ended 31 March 2013.

Echo Inc is resident overseas. The other companies are all resident in the UK.

All the companies are trading companies except for Flute Ltd which is dormant.

· Alto Ltd and Flute Ltd are not associated companies as Music Ltd has a shareholding of less than 50% in Alto Ltd, and Flute Ltd is dormant.

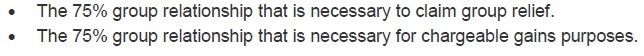

Definition of a 75% group

There are two types of group relationship:

The definition of a 75% subsidiary company for chargeable gains purposes is looser than that for group relief purposes. This is because the required 75% shareholding need only be met at each level in the group structure.

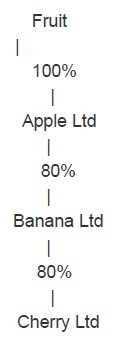

Example 2

Fruit Ltd is the parent company for a group of companies. The group structure is as follows:

For the year ended 31 March 2013 Fruit Ltd has an unrelieved trading loss.

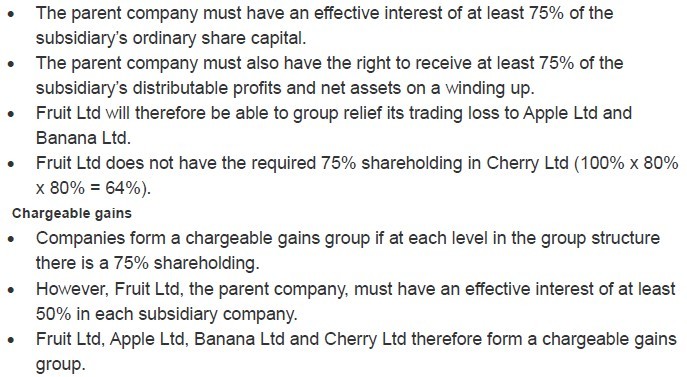

Group relief

Group relief

Remember that group relief is not restricted according to the percentage shareholding. Therefore, if a parent company has a trading loss then 100% of that loss can be surrendered to a 75% subsidiary company, and if a 75% subsidiary company has a trading loss then 100% of that loss can be claimed as group relief by the parent company. Unlike other loss relief claims, the claimant company claims group relief against its taxable total profits after the deduction of any qualifying charitable donations.

Example 3

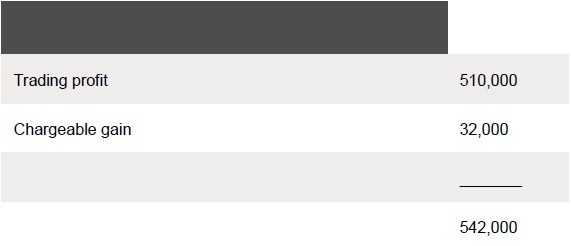

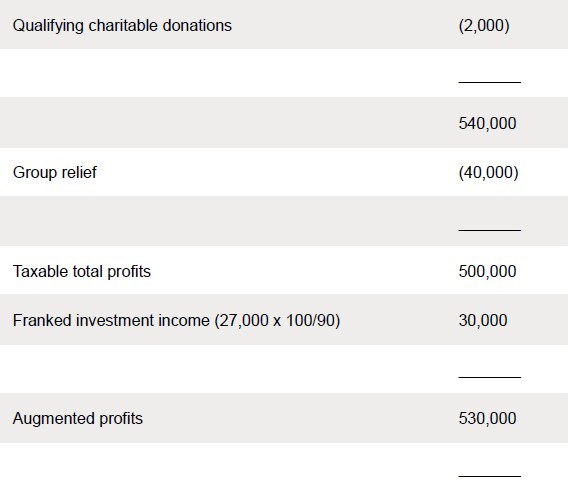

For the year ended 31 March 2013 Ballpoint Ltd has a trading profit of £510,000, a chargeable gain of £32,000, and paid qualifying charitable donations of £2,000.

Ballpoint Ltd has a 100% subsidiary company, and for the year ended 31 March 2013 claimed group relief of £40,000 from this company.

During the year ended 31 March 2013 Ballpoint Ltd received dividends of £27,000 from an unconnected UK company, and dividends of £18,000 from its 100% subsidiary company. Both figures are the actual cash amounts received.

The corporation tax liability of Ballpoint Ltd for the year ended 31 March 2013 is as follows:

When the accounting periods of the claimant company and the surrendering company are not coterminous, then group relief may be restricted. There may also be a restriction where an accounting period is less than 12 months long.

Copyright © 2000 - www.chinaacc.com All Rights Reserved. 北京正保会计科技有限公司 版权所有

京B2-20200959 京ICP备20012371号-7 出版物经营许可证 ![]() 京公网安备 11010802044457号

京公网安备 11010802044457号